Electronic invoicing or e-invoicing is the way to go. From Jan. 1, 2026, digital invoicing will become mandatory for all invoices between companies, not just those to government agencies. An automated invoicing cycle offers plenty of benefits, and more and more companies are adopting it as part of their “digital journey. Why your organization shouldn’t miss the boat either and how to efficiently switch within your Dynamics 365 Business Central…

Start with E-invoicing

It may not be a “must” for your company right now (yet), but it still makes sense to think about this already. Those already on board are clear. The benefits of electronic invoicing speak for themselves:

- Clearer, faster and less chance of errors

- Futureproof towards future government obligations

- Secure and structured

- One solution for the various administrative and accounting tasks

- Also easy for purchase invoices on paper or in pdf

- Simplifies international trade

- More and more companies are using and requesting e-invoices

Back to the beginning

It has to be said: electronic invoicing originated from an idea of the government, as a means of combating VAT fraud. No superfluous luxury, when you know that the government in Belgium is missing 4.6 billion euros in VAT revenues, within Europe that is just under 100 billion euros. The structured exchange of invoice information will therefore become mandatory in our country:

- For every company that sends an invoice to the government – as of March 1, 2024

- For invoices between B2B companies – from Jan. 1, 2026

For this, all eyes are on Peppol, an “agreement framework” that allows companies to exchange e-invoices among themselves using different formats and according to a protocol. Access points give you access to the secure network to send and receive invoices.

Companies participating in that the Peppol network benefit from a secure and efficient way of document exchange, without having to worry about the compatibility of different software packages, document security or the many international government deadlines and requirements.

Dirk Willekens, internationale Peppol-autoriteit and E-invoice Program Manager bij Billit

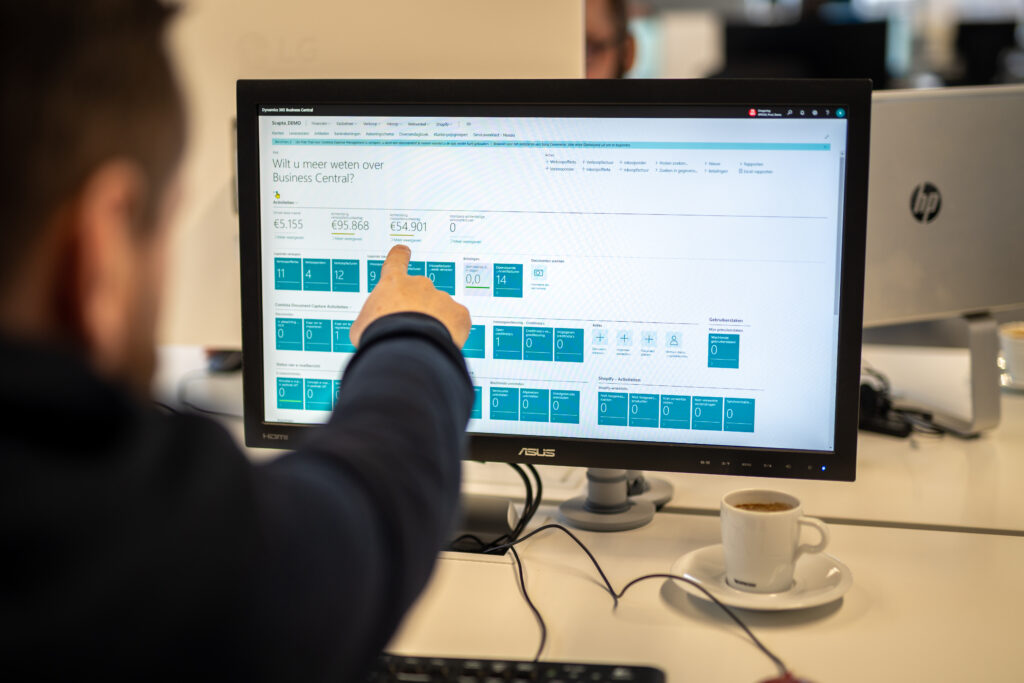

The perfect match with your Business Central

For integrating Peppol into your own systems, there is scapta. We are 100% behind Billit, expert in the invoicing market and largest Peppol access point provider worldwide. In partnership with Billit, we provide custom integration into Microsoft Dynamics 365 Business Central. Scapta speaks 1 language to Billit and Billit handles the translations to all countries, packages and requirements. Expertise and relief pur sang.

scapta integrated Peppol into our ERP. Peppol’s standardized format simplifies our billing in compliance with security protocols, automates our billing cycle and reduces operational costs. Yes, very satisfied with scaptans functionality and approach.

Rutger Nuyts, CFR Industry Parts Limburg

Goodbye complex invoicing and time-consuming administrative tasks. We simplify, improve and secure your invoicing processes. That too is called growing. The Billit API ‘XPR365 Peppol by Billit‘ is available in the Microsoft App Store. Get more information from your current software partner, or from scapta of course.

Increased cost deduction of 120% for e-invoicing software and consulting

Recently, the House of Representatives approved a legislative amendment encouraging companies to move to e-invoicing through a tax break.

Between 2024 and 2027, companies can benefit from an increased cost deduction of 120% for both e-invoicing software and consulting services. This includes subscriptions to software such as Billit and consulting by experts.

Do you have further questions on this topic or are you interested in implementing the Peppol integration in your company? Then don’t hesitate and feel free to contact us using the contact form below. We are ready to help you!